From Boom and Bust to AI-Driven Evolution

“It turns out the biggest use case for AI is fraudsters committing fraud against financial services companies. Financial fraud is growing it like like 18 to 20% a year, which is insane. And it’s already a huge market.” This stark observation from Zach Perret, cofounder and CEO of Plaid, during a recent discussion on The A16Z Show, cuts through the typical hype to highlight one of the most critical challenges and opportunities facing the financial technology sector today.

Perret, alongside a16z General Partner David Haber, joined Erik Torenberg, also an a16z General Partner, to unpack the tumultuous journey of the fintech industry. Their conversation traversed the dramatic “seasons” of fintech, from its nascent growth to a pandemic-fueled boom, through a subsequent deep freeze, and into its current re-emergence.

The period between 2018 and 2019 represented a “late spring” for fintech, characterized by robust growth and the widespread recognition of fintech as a distinct industry. Innovative applications like Robinhood and various neobanks targeting specific market segments began to flourish. Then came 2020 and the onset of COVID-19, which, after an initial freeze, unleashed an “utter insanity of a story” for fintech. Venture capital poured into the sector at unprecedented rates; at its peak, “like 25% of all venture dollars in that period went into fintech.” This explosive growth, dubbed “fintech summer,” saw a surge in new companies and digital adoption.

However, this euphoria was short-lived. The second half of 2022 and most of 2023 plunged the industry into a “fintech winter,” where venture funding for the sector “collapsed to almost zero.” This deep freeze forced a reckoning, emphasizing sustainable business models and operational efficiency over hyper-growth at all costs. Now, in 2024, the market is thawing, signaling a return to “spring,” albeit with a different, more mature dynamic.

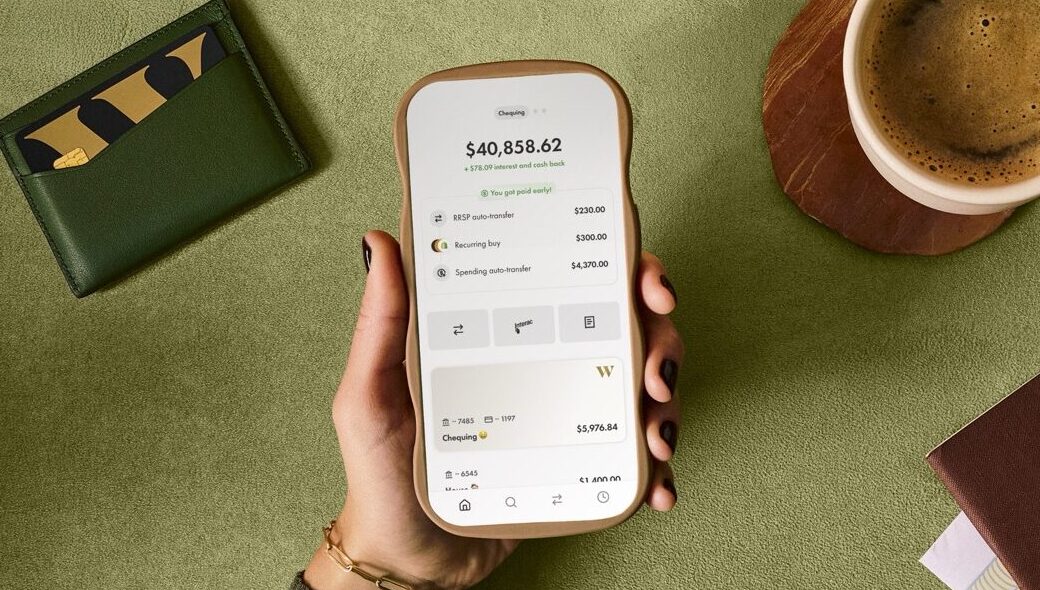

The industry’s maturation is evident in its expanded scope. Fintech is no longer just about challenger banks or payment apps; it has become “synonymous with financial services.” The rise of embedded finance sees traditional non-financial companies like Ford and John Deere integrating financial services directly into their offerings, blurring traditional industry lines. This profound shift means that financial services are now seamlessly woven into everyday experiences, moving beyond dedicated financial apps.

One of the most compelling insights from the discussion centers on the dual nature of AI. While AI holds immense promise for optimizing financial products, enhancing customer experiences, and improving underwriting, it simultaneously fuels an escalating battle against fraud. Fraudsters are leveraging AI to create more sophisticated attacks, leading to an alarming 18-20% annual growth in financial fraud. This necessitates a continuous, agile response from fintech companies, requiring constant innovation in defensive AI technologies.

The shift in the macroeconomic environment, particularly rising interest rates, also played a pivotal role in reshaping fintech. Previously, many fintechs focused on lending, thriving on low-cost capital. As rates climbed, the profitability of these models shifted, leading many companies to focus on deposits as a revenue stream. This forced a strategic re-evaluation, pushing some to pursue full-stack banking licenses to control their deposit base. Simultaneously, traditional incumbent financial institutions, once wary of external tech, have changed their tune. As David Haber observed, “The posture of a lot of the incumbent financial institutions to fintech and technology broadly… For a long time, many of these institutions were like, if the technology wasn’t built there, they weren’t interested… Now, many of them have now rebundled.” They assert a newfound willingness to adopt external software and integrate innovative solutions, including AI, into their vast operations.

Plaid, a foundational player in open banking, has navigated these shifts by focusing on solving the “access problem.” Initially, this meant enabling digital connections to bank accounts, allowing consumers to open accounts or get loans online rather than through physical branches. The industry has largely achieved this. The next horizon, Perret suggests, is moving beyond mere digital access to achieving “excellence” in financial products. This involves leveraging data and AI to create more logical credit scoring, offer truly personalized financial advice, and automate wealth management.

The path ahead for fintech is marked by both immense potential and significant challenges. This new spring promises innovation, but demands vigilance.

link