The chief executive officer of Toronto-based financial technology firm Wealthsimple this week reflected on his company’s 2025.

Cofounder Michael Katchen remarked in a memo that Wealthsimple’s mission is the same as it was when the Ontario fintech launched in 2014: “by making financial tools simpler and more accessible, we could help Canadians build lasting financial freedom for generations to come—and contribute to a stronger, more prosperous Canada.”

In what he describes as a “remarkable year,” the entrepreneur noted how Wealthsimple now manages more than $100 billion in user assets, a doubling in just one year.

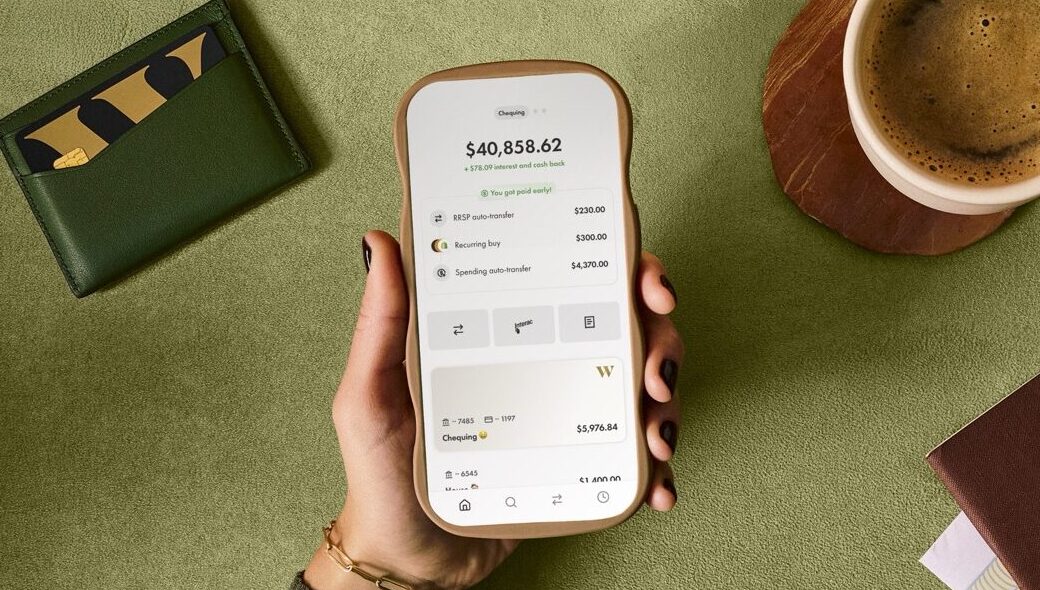

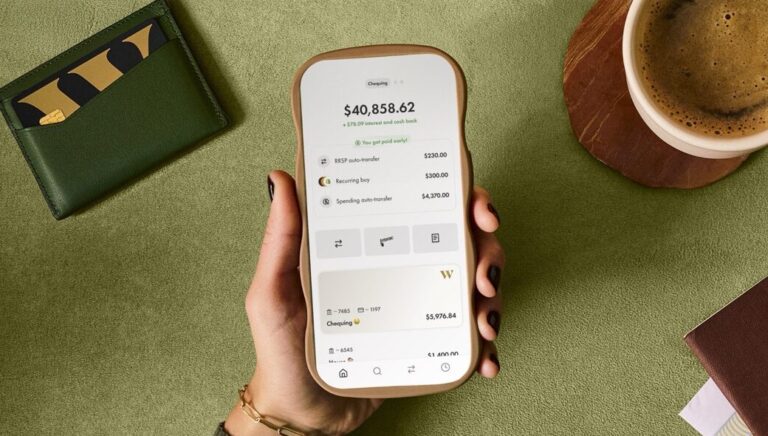

That growth in assets under administration follows the addition of more than 650,000 new clients throughout the year, according to Katchen, who says Wealthsimple users gained $10 billion in wealth through market gains and earned $200 million from high-interest chequing accounts.

Client growth has come steadily as Wealthsimple continues to frequently add new features to its platform, aiming to bolster the “sophistication” of financial toolkits while retaining an inherent simplicity (it’s in the name, after all) that made the product stand out in the first place.

“This year we took some of the biggest steps in our history toward serving you more completely and launched the most products we ever have in a calendar year, many in direct response to your feedback,” Katchen stated. “We added features like bank draft delivery, mobile cheque deposit, USD savings accounts, and international money transfers so you could finally use Wealthsimple as your main financial partner.”

Other “sophisticated trading tools to level up your portfolios” launched, the CEO added, including margin accounts, expanded options strategies, 24/5 trading, and self-directed RESPs, while a long-demanded credit card is finally reaching users.

“By the end of the year, 100,000 of you will have been invited to use the Wealthsimple credit card,” Katchen said. “We’re excited to get it to even more of you in 2026.”

A big part of Wealthsimple’s successful year was raising nearly $1B at a $10B valuation, which allows the company “to continue scaling from a position of strength,” according to the CEO.

“The business is growing, and we continue to be profitable,” Katchen noted.

In 2026, he says, “we plan to expand our spending and investing services further” in order to “scale financial advice” and deliver to everyday Canadians “investment opportunities once reserved for the wealthy.”

link