Red Hat: Latin America’s financial technology moment is now

As financial institutions across Latin America accelerate efforts to modernize operations, the Financial Services division of enterprise open-source software provider Red Hat is playing a pivotal role.

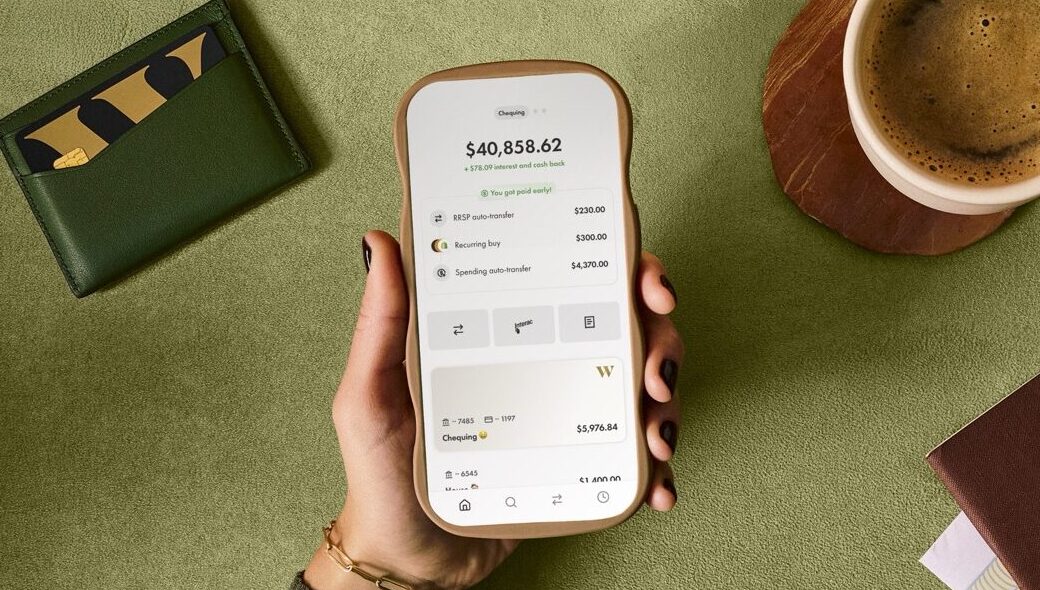

The unit offers platforms and solutions tailored to banks, insurers and investment firms aiming to adopt artificial intelligence (AI), leverage cloud infrastructure and drive faster innovation while managing risk. Red Hat collaborates with key fintech partners including SWIFT, Temenos and Finastra to integrate its open-source technologies into core banking, digital banking and payment systems.

In this interview, Richard Harmon, vice president of global financial services at Red Hat, discusses how Latin American firms are leapfrogging legacy systems, what to expect from AI adoption in 2026, and why the region is becoming one of the company’s fastest-growing markets globally.

BNamericas: We’re already closing out the year and 2026 is right around the corner. What are your global and Latin American outlooks for the financial services segment?

Harmon: Globally, and especially in Latin America, we’re seeing a continued wave of modernization across financial services—exchanges, banks, insurers—and that will continue. But now it’s being driven more by AI and automation. It’s no longer just about shifting to containers and microservices. We’re seeing a shift toward what I call “intelligent automation”, where automation doesn’t just execute, but also thinks, evaluates, and decides.

Most agentic AI right now operates in support roles—pulling data, analyzing, suggesting—but not yet running core systems, mainly due to governance, transparency and control concerns. Still, it’s a very exciting period. AI is evolving so fast that even those on the cutting edge struggle to keep up. You can’t plan five years ahead anymore; it’s about what happens in the next six months.

BNamericas: Financial services have historically been at the forefront of tech adoption, especially in Latin America. Brazil’s PIX system is a standout example. But many companies still struggle to see returns on their AI investments. What’s the current state of ROI?

Harmon: Early on, I wouldn’t expect clear ROI. After completing my doctorate, I spent time as an academic, and I view this as a learning phase. These early AI efforts are meant to educate the whole organization, not just build a black box with a few specialists.

Firms like J.P. Morgan may have thousands of AI experts, but smaller banks may only have dozens. Still, all institutions can benefit. We’ve seen large banks in Brazil, for example, experimenting in very structured, forward-looking ways.

But the secret is avoiding hundreds of siloed projects. You need a unified platform that supports visibility, standardization and control. That way, institutions can apply AI safely and scalably.

BNamericas: So what you’re saying is that ROI shouldn’t be expected too early—2026 could be a more ROI-focused year?

Richard: This year is still about experimentation and integration. But in 2026, I expect more companies to start delivering AI-powered tools that impact customers and operations—tools that improve efficiency and introduce new products or services.

But there are cases and cases. Take customer service agents. Some banks in Brazil, Argentina and Colombia—Galicia comes to mind—have used AI in this area for years.

AI listens to the conversation and provides agents with relevant information in real time, even analyzing customer tone. It can also reroute issues to the right team. This has led to 5x to 50x increases in agent productivity—and better customer satisfaction.

These are not futuristic use cases. Some date back two years or more.

BNamericas: And even further back, IBM worked with Bradesco on machine learning as early as 2016. So, moving on – Dell recently predicted 2026 will be the year of orchestration and integration in AI. Does that resonate with you?

Richard: It does. We’re seeing a rise in agentic AI—systems that can dynamically respond to situations. One example is a simulation company called Simigon. They’ve shown that LLMs can build agent-based simulations equivalent to what experienced engineers would take days to code.

Most breakthroughs will likely appear in operations and markets—not direct customer interfaces—due to regulatory concerns. But AI is already proving valuable in areas like financial crime, fraud detection, and anti-money laundering.

A global compliance leader shared that they use LLMs in trade finance to analyze communications, contracts and emails to detect collusion or manipulation. One LLM spotted a capitalized letter in the middle of words across multiple pages—a pattern a human might miss. That small anomaly revealed coordinated behavior. AI caught it fast.

Nation-state actors are also using AI for crime. So using AI to counter AI-driven fraud is critical.

BNamericas: Beyond AI, quantum computing is another tech trend often linked to finance, but yet to materialize. How close are we to real-world adoption in the segment?

Richard: IBM’s open source approach has given it a leadership position in quantum. They had nearly a million users even a few years ago. HSBC and IBM recently co-developed a risk management algorithm, which is a hint of what’s coming.

Quantum will shine in areas like risk management, where it can detect subtle market patterns that even LLMs can’t. It’s not about speculative trading – it’s about managing risk better.

Quantum cryptography might arrive in the next year or two. But for broader quantum adoption in finance, I’d say we’re still three to four years out.

BNamericas: One sharp question: Is there a bubble in AI?

Richard: I’d say there’s a bubble in the infrastructure side – huge upfront investments in data centers, for instance. That could backfire if the returns don’t materialize.

But the software and applications side is not a bubble. We’re seeing real gains. Still, everything depends on the macroeconomic context. Even if there’s no bubble today, a global shock could change everything.

BNamericas: Back to Latin America. Beyond PIX and similar systems, what is Red Hat seeing in the region?

Richard: Latin America is our fastest-growing geography. Brazil especially is very advanced, but other countries are innovating too. You’re leapfrogging older tech because you don’t have the legacy baggage of North America or Europe.

This is like the mobile revolution – you went straight to 4G and 5G while others kept landlines. You have top-tier universities, strong technical talent, and the brain drain is slowing. That’s great for LatAm.

BNamericas: And how is Red Hat positioning itself?

Richard: We’re focused 100% on open source and building resilient, scalable platforms.

More institutions are adopting our OpenShift platform for hybrid, multi-cloud deployments. We don’t want to lock anyone in. Our goal is to provide the tools they need to choose how and where to run their systems.

And the global open source community, including many Latin American developers, is what drives the innovation we bring to market.

(The original version of this content was written in English)

link